This accounting system allows you to work out the individual cost of manufacturing for a product and apply the right mark-up to get the project margin you desire. You might look at each project in detail – down to costs, materials, and overhead. Look at where the inefficiencies are in the production process and where the waste is coming from, adjusting the pricing if required. Standard costing is useful if you are making similar products or large quantities of a specific product. Direct material (or raw material) inventory is a calculation of all the materials your manufacturing business is using to make your product – all the materials consumed or identified with your product. To reduce the costs of doing business, you must understand first where your production costs lie.

- Direct labor is the value given to the labor that produces your goods, such as machine or assembly line operators.

- Assume that finished goods are transferred from the factory to the warehouse at production cost plus a 10% manufacturing profit.

- This ensures the business stays on track by assigning the appropriate sales prices for the products.

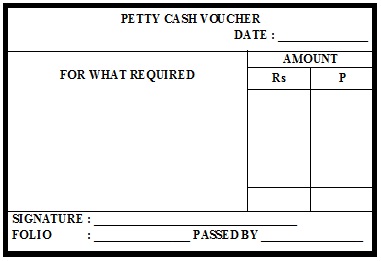

- Maintaining accurate and organized records of all the transactions and costs involved in production can be incredibly laborious if you do it manually.

- This includes wages paid for workers who operate machines, assemble products or package goods.

- If you are spending more on manufacturing the product than necessary, you will not meet your income targets.

Periodic Inventory System

This ensures seamless data movement between the shopfloor, inventory, and the back office, and further simplifies managing your business. If you are yet to implement a manufacturing ERP system, consider picking one with built-in financial reporting capabilities. For example, MRPeasy includes one-click product cost estimating, intelligent reporting, and built-in integrations with major financial software providers like Xero and QuickBooks Online. ABC is a very accurate costing methodology that helps to factor indirect costs into unit pricing. It can be more difficult to implement than standard or job costing, however, as a more detailed overview is required over the manufacturing process. The overhead cost of a cost pool is then divided by the number of units in the activity to arrive at the activity rate – a fixed amount that is added to each unit’s cost.

The last-in-first-out (LIFO) inventory valuation method is the opposite of the FIFO approach. Process costing is beneficial for saving time as calculating costs need not to be completed for each individual unit. The downside is that the costs per unit can become inaccurate since rounding up costs per process can introduce discrepancies. Job costing is advantageous for returning close-to-exact cost values per finished project or finished good. It is sometimes difficult to manage, however, as individual tracking and allocation of costs can be time-consuming. In addition to per-part inventory costing, it is also important to track the total number of on-hand inventory why changing the corporate tax rate doesn’t help you units.

The Benefits of Having a Manufacturing Account

This depends on whether the labour requirements of a particular job change as you add more volume. Manufacturing costs can also be categorised as either variable costs or fixed costs. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Direct Costing

Though it takes more work than applying a standard overhead rate, it generates more accurate cost estimates. Variable costs are expenses that a company bears proportional to its production volume. A good example would be the costs of packaging for finished goods but also utilities like heating and water, as well as some labor expenses, etc.

See the standard costing, weighted-average method, FIFO, and LIFO topics for more information. With proper inventory management, you can ensure a steady supply of materials while keeping expenses under control. Manufacturing accounting is a complex process that requires specialized knowledge and skills. In order to ensure accuracy and efficiency in the process, there are certain best practices that should be followed. By applying inventorial techniques to these costs, businesses can identify areas where spending can be reduced, efficiency can be improved, and profitability can be increased. This blog post will explore a range of indispensable tips and proven strategies specifically tailored to the unique challenges of accounting in manufacturing.

Manufacturing business owners can also consider financing what financial ratios are best to evaluate for consumer packaged goods options such as invoice factoring to maintain a streamlined flow of money in their operations regardless of the market outlook. The above methods will also help businesses choose what suits their operations the best, ensuring production performance is optimal and profits are commensurate with expectations. Financial accounting is primarily concerned with the creation of core financial statements such as cash flow reports, balance sheets, income reports, and profit statements. These documents are important when the manufacturing business needs to showcase its credibility and financial performance to investors or funding partners when raising capital.

When tracking manufacturing expenditure, it’s important to understand both direct and indirect costs. The first consideration is whether the software is user-friendly and intuitive. Most small business owners haven’t studied accounting, and the software should help you do accounting for warranty expense basic bookkeeping and accounting easily without too much of a learning curve. You should also be able to access and understand your financial reports quickly.

Leave a Reply